I remember the first time I bought a home. The two emotions I felt at the time were excitement and fear. Excitement because I was buying a house and fear…because I was buying a house! The fear came from the uncertainty of not knowing if I could afford what I was about get myself into. Twenty years ago it was hard to get an idea of how much income I needed for a specific mortgage. Now everything is different, there are hundreds of on-line apps that you can easily access which give you an exact number for how much you’ll need to earn to get a specific mortgage at a specific rate.

Here is one of the best that we’ve found. It is provided by Nerd Wallet and it gives a clear idea of your financial picture. It tells you if you qualify for the loan you want and the rate that you will need to lock in to pay a certain amount. It also gives you one other thing: peace of mind.

A few things to note:

- Federal government loans from the VA, FHA and USDA have unique and specific requirements. If you are arranging a loan through one of these entities please consult their guidelines for more information.

- The calculator gives an estimate. Different lenders may have different qualifications that take into account your credit history, the house value and the area in which you are buying.

Do you know the six most common mistakes made by first time home buyers?

For example

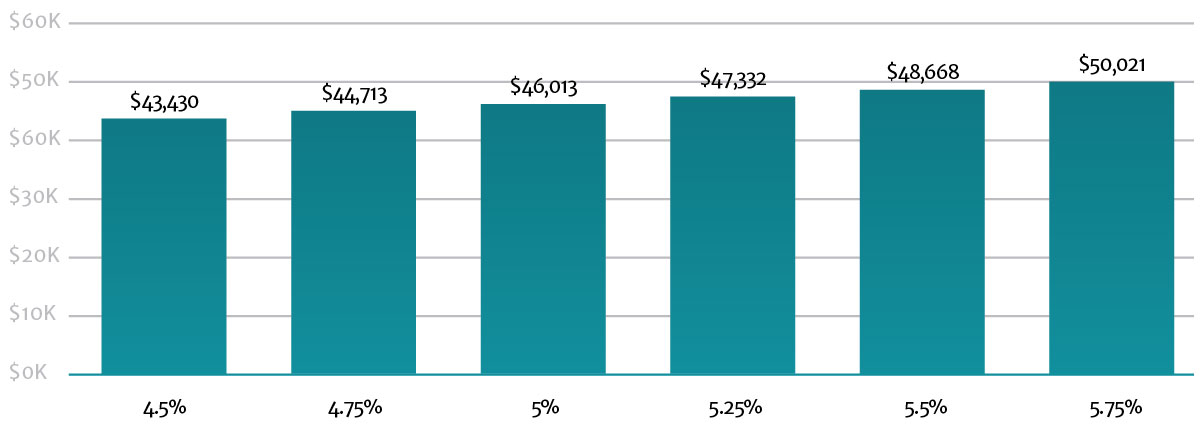

As a starting point the graph below offers a general idea of the annual income required for every $200,000 of a 30 year loan taken at various interest rates.

Conclusion

Knowledge is power and in this case it is power over uncertainty and worry. There is no need to be in the dark these days, with a few clicks of your mouse you get a clear picture of where you stand regarding your mortgague.